Fast Unsecured Business Loan for Small Businesses

Do you require funds urgently to keep your business running? Unexpected payment delays? Need to pay rental or salaries soon? With our business loans, you do not have to worry about financials. We help you keep your focus on what really matters. The growth of your company.

Apply Now

Our Business Loans are designed to help your business

- Improve cash flow

- Salaries Payment

- Rental Payment

- Inventory & Stock

- Buying of Equipment

- Office/Shop Renovation

- Business Expansion

- Infrastructure Investment

- Marketing Costs

What Our Customers Say

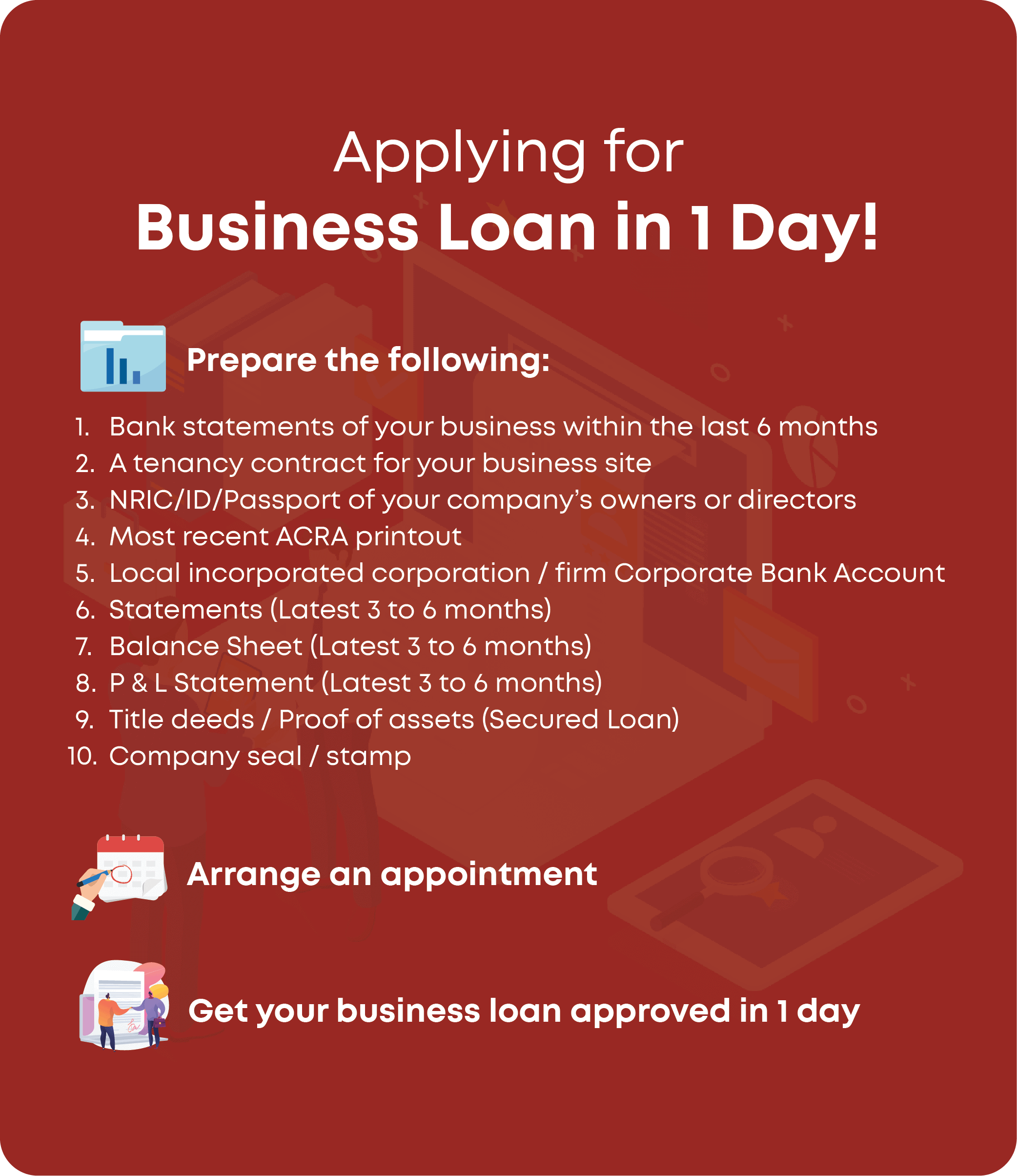

Simple Business Loan Application Process

All you need to do is to fill up our simple online application form and wait for your appointment details.

For the appointment, you will need to prepare the following documents:

- Bank statements of your business within the last 6 months

- A tenancy contract for your existing business site

- NRIC/ID/Passport of your company’s owners or directors

- Recent ACRA Information (within 6 months)

- Corporate Bank Account Statements (Latest 3 to 6 months)

- Balance Sheet (Latest 3 to 6 months)

- P & L Statement (Latest 3 to 6 months)

- Title deeds / Proof of assets (Secured Loan)

- Company seal/stamp

Apply for a Business Loan Now

*All fields are required.

Frequently Asked Questions

For most cases, our customers will be able to get the funds on the same day.

At 1 - Credit Hub, there is no requirement for guarantor to make a loan.

- Banks impose strict qualifications and the loan approval process can take a very long time. At 1 - Credit Hub Capital, we keep things simple. The approval process is fast and straight forward.

Find out more

- Business Finances

A Financial Guide to Starting Your Own Business

Starting a business requires a great deal of financial consideration. Here, we discuss starting your own business in a financially viable (and successful) manner.

Loans: The good, bad, & ugly

Moneylenders have several perks for you as a borrower; especially if you know you are going through a licensed moneylender. But, there are also some things that are not so [...]

Life After Bankruptcy: Are You Still Eligible To Apply Business Loan?

Once you have declared bankruptcy in your business, you are probably left wondering if there is even a possibility to get out of it. The question hanging in your head [...]