Fast Payday Loan

Get the EXTRA CASH you need with a Fast Payday Loan.

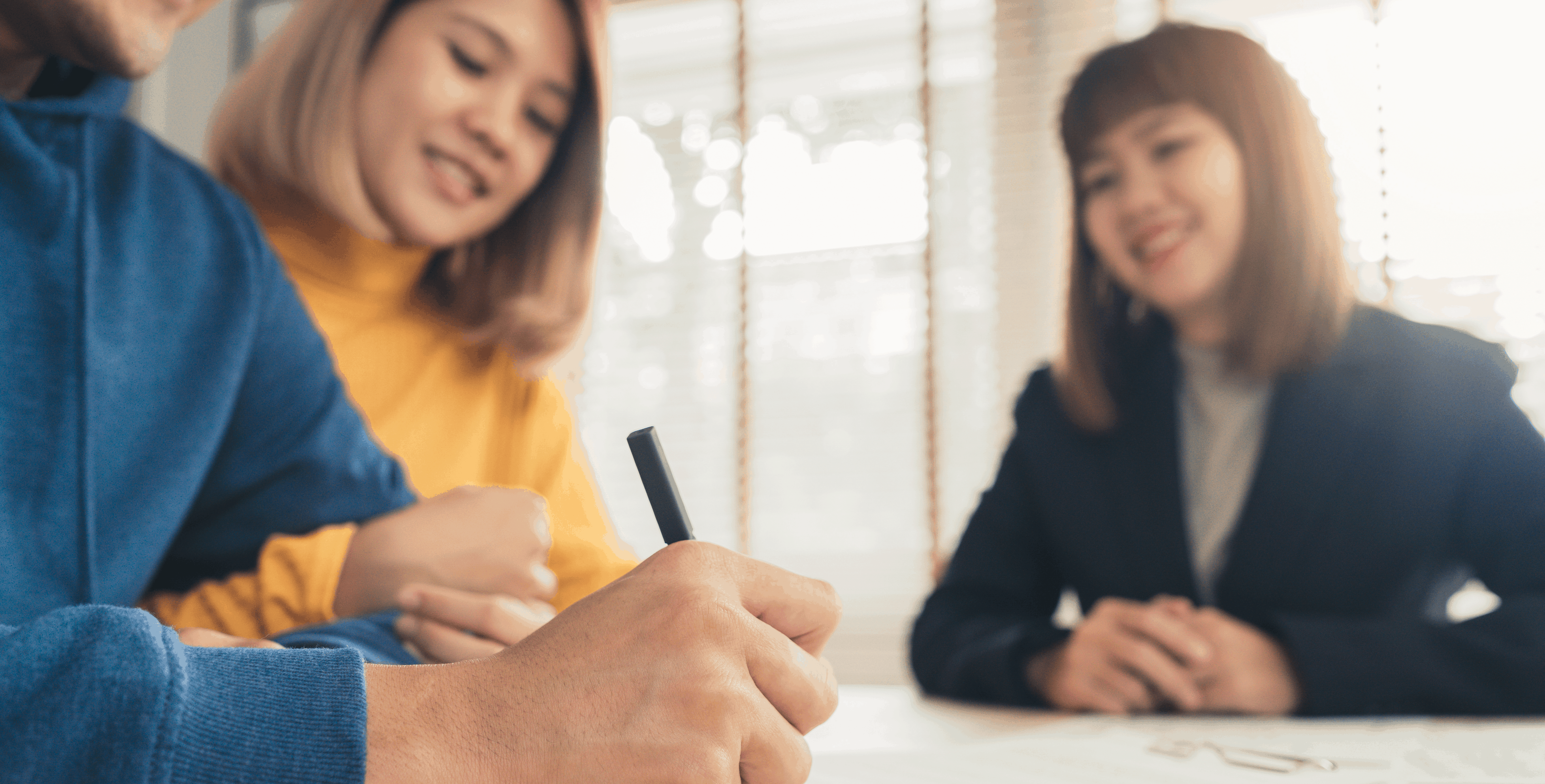

Do you have several expenses piling up concurrently? If all of these needs to be cleared off immediately, but you are running dry on your finances, who can you do? A Payday loan would be an ideal alternative for you. With Fast Payday Loan Singapore, you are able to free up your financial concerns, sparing yourself from creditors who may be knocking on your door soon.

LOAN

up to SGD$300,000

REPAYMENT

from

12-18 months

INTEREST

from

1%-4%

APPROVAL

in

1 day

Are you ready to take out a fast payday loan today?

1 - Credit Hub Pte Ltd reserves all the rights to amend terms & conditions without any prior notice to customers. The borrowers have no obligation to take up the loan if the loan package offered is not satisfied.

Low on Cash? 1 - Credit Hub’s Fast Payday Loans Got You Covered!

For employed individuals who need additional cash to resolve their financial concerns, a payday loan is another viable option.

This short term loan is granted to those who are receiving a monthly income from their regular jobs. Through this type of loan, you should be able to settle your own monthly bills even if you do not have much cash on hand. As long as you are able to repay your loan the next payday, you can take out a fast cash loan without any problem.

Apply Now

If there are some special requirements you may have regarding your payday loan, we will gladly make any changes to cater to your needs. Just contact us via phone, email or visit us at our office if you have further concerns. You can rely on us to get back to you promptly.

Apply for a Payday Loan now

*All fields are required.

Quick Finance Tips

- Quick Finance Tips